What has Toms Shoes; Warby Parker; The UK Lottery; Dog for Dog AND Insurance companies got in common?

UK National Lottery – people pay money each week on the basis that they may get a big pay-out plus there is the feeling that a portion of money also goes to good causes along the way, both local and national projects such as Sport and the Arts, huge social impact.

Warby Parker – Glasses – Buy a Pair, Give a Pair program. Alleviating the problem of impaired vision is at the heart of what they do and continues to expand. And more recently getting local with their Pupils Project, a program with a number of organizations and local government agencies, like the Department of Education in New York City and the Department of Health in Baltimore, that provides free vision screenings, eye exams, and glasses to schoolchildren. According to the Center for Disease Control and Prevention, vision disability is the single most prevalent disabling condition among children in the U.S.; The Pupils Project model eliminates barriers to access by providing free prescription glasses and meeting children in their classrooms, where vision issues often first come to light.

Toms Shoes – as the original One for One company their community has given away more than 100 million pairs of shoes. This has created a huge impact in the world as well as spawned many other companies to do the same. They are now committed to giving away one third of their net annual profits. This allows global and local issues to be supported and enables more of their community to be involved. Global goes local.

Dog for Dog – is a high-quality dog treat, care and accessory product company with a mission to help dogs in need. Dog for Dog has an online community committed to enhancing the life of our best fur friend via proper nutrition, care and play, and they strive each and every day to deliver the cleanest, most-nutrient rich dog treats to dogs across the country, whether in cosy homes or waiting to be picked up at the local rescue shelter.

It seems that more and more having a heart, servicing social impact and a community sells a product and attracts employees and committed people to work with and for you.

Millennials like community, social impact and good causes but are now seen to be moving past their initial save the world global ambitions to focusing on local real issues that they can support and make a real difference. This is also reflected in the companies highlighted above – early on it was one BIG issue and now they are moving on to local projects and ideas to support social impact.

At a fundamental human level, millennials are showing that they’ve had enough with abstract goods. They want a sense of wholeness in their lives, wholeness built from healthy relationships, responsibility, belonging, an identifiable role. There’s an inherent personalism involved in choosing the local – it demands real conversations in real-time, real meals around real tables, and real problem-solving and sacrifice, less hash-tagging and virtue signalling.

And now we switch back to that question – What has Toms Shoes; Warby Parker; The UK Lottery; Dog for Dog AND Insurance got in common?

Nothing much I hear you say. Totally abstract product. Big corporates fixed on profits for their shareholders. Nothing community about it. Always in the news for poor customer service and not paying on their obligations. Global and not local. Zero social impact. But is this true?

What is the underlying principal of insurance?

If you Google this it comes up with the basic 6 or 7 principles of Insurance, these principles all underline the abstract nature of insurance and fully proves there is no heart in an insurance product.

However, I am digging deeper here…

The principle I am searching for is that of Community. And this is found at the very start of ‘insurance’.

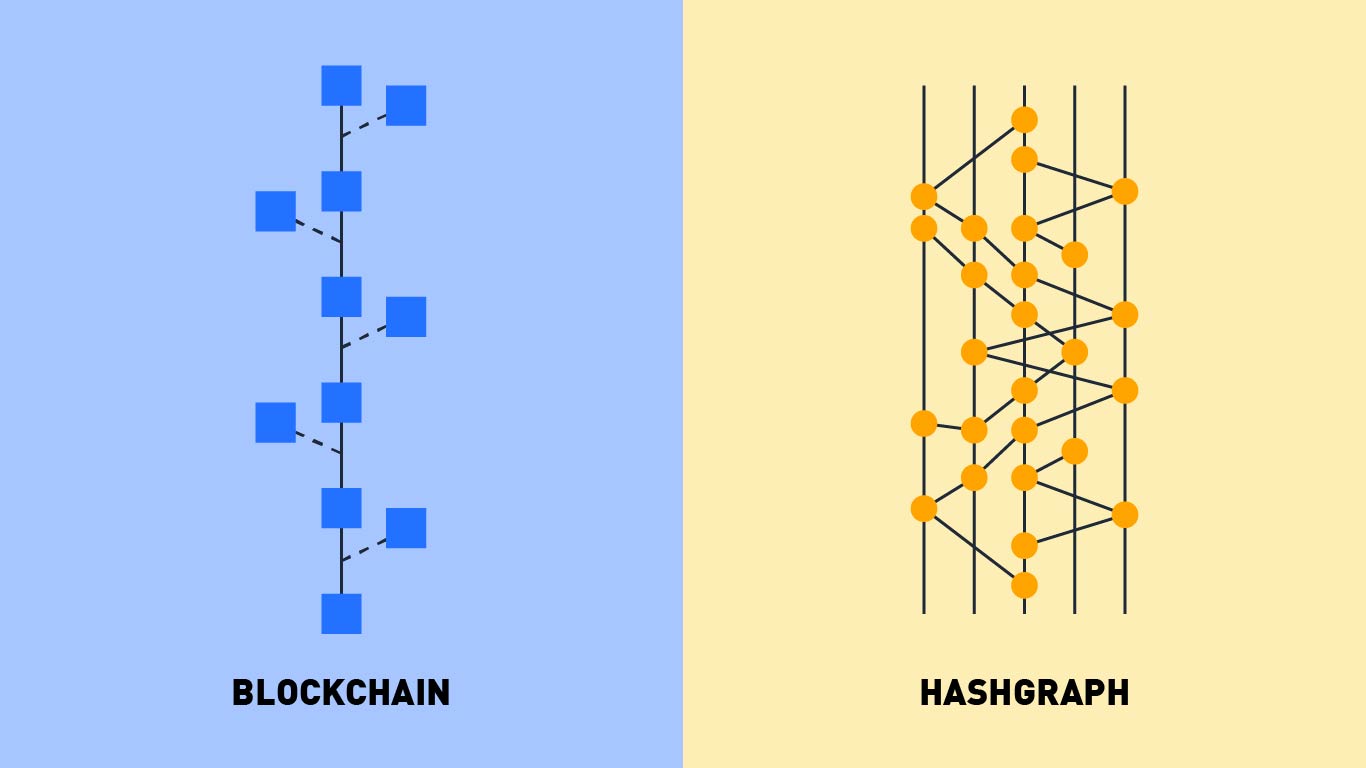

Insurance dates back to prehistory. People sold goods in their own villages or gathering places or travelled to nearby villages and towns. Two main form of trade existed – ‘barter’ and currencies’. Forms of Insurance was also developed in these economies too ‘mutual’ and ‘community’. Both are forms of these groups of people getting together to help when one or more of the communities falls on hard times.

Mutual would be if one family’s house gets destroyed, the neighbours are committed to helping rebuild it.

Community would be where public granaries store grain to indemnify against famines.

This is a natural and good spirited development and one that is fully replicated in Insurance of today – except that the heart has been lost and certainly the companies fail to expresses this in their core messages. Its all about the company, not the community.

Today, when you buy an insurance policy for your car, you are not really expecting to call upon it that year or in fact any time soon. Or if you buy Holiday insurance you are not thinking your holiday will be a disaster. It’s just in case. The idea is that your ‘premium’ goes towards others who do have an accident or a loss. The Community of car drivers and holiday makers are in effect clubbing together to pay-out in the event of one (or a few) of the community having an accident or suffering a loss. The insurance company is just holding the money.

Except that is not how it is sold or shown in adverts – there is no idea of community or of the business model behind insurance. Today its sold as a law (legally you need insurance to drive) or prudent or fear (home insurance) or must have (business contract necessity).

The sense that the insurance company is the custodian of the community in times of need is not something that you see in many (any) of the adverts or as part of their websites.

Mostly these adverts are enjoyable (or annoying) 30 second slots of brand recognition between the cable news. Or the company web site is a confusion of corporate and product company speak. They present the Company as helping not the community and this presented in a huge legal policy of what forms a claim etc, which is confusing and boring just as they promise in their TV adverts.

Insurance really is the ultimate community program and one that all millennials and new business gurus should be all over. Instead the insurance industry is dominated by #okboomers and struggles to attract young talent to drive their businesses forward.

Thousands of policies are sold and only a few result in a claim – this is the community model. The claims should be the thing that is promoted as a positive. The insurance companies call these LOSSES as though it’s a big negative. Expressed in their loss ratios and combined ratios. In fact, the claims and claims process should be the central celebration in the insurance industry.

Back in the early days of communities mutually coming together to rebuild a farmhouse destroyed in a fire, imagine the sense of good will and community sprit that would have been there on that day when the home is re-built and the family restored. What insurance company brings that level of sprit to their policy holders?

This is lost in the modern world of insurance. Claims are often outsourced to a third party administrator and the measures of customer satisfaction struggle to get off the bottom run compared to other industries.

Insurance companies are also seen as profit grabbing and money-making machines, yet their actual underwriting performance is often poor. This is expressed in their Combined Ratio – losses and loss adjustment expenses as a percent of earned premiums.

This chart shows that the actual performance of the industry is really poor – of the 19 years on the chart only 8 year showed an underwriting profits.

This should all point to a huge community sprit – they don’t even profit from the products they sell!! (OK, I do know they profit and they have very inefficient models but this is another story and an opportunity).

On customers – most of the brands we see on TV are well below where they could be. JD Powers survey puts most of the companies and categories in their lowest segment once you move away from the top 4 or 5 companies.

So, again back to the question, what do the companies have in common? Quite a lot on paper and nothing in practice or perception I think.

Is this the central failing in the industry – the inability to get away from the legals and to bring out the community spirit? Is this the opportunity that has been missed in the insurtech boom? Is this the central reason why young people don’t want to join the insurance industry?