We, MIC Global, have our own definition of ‘microinsurance’ and the following hopes to explain this.

Generally ‘microinsurance’ refers to providing insurance to low-income families in developing countries and continents. We like to offer a broader definition, this is where insurance products are developed to provide a specific coverage for a specific need or event. This generally results is a lower cost to customers for that event when compared to a monthly or annual cost for more traditional insurance.

Unlike generic products, microinsurance brings down the cost for consumers by putting in innovative constraints on ‘coverage’, ‘time’ or ‘usage’. The ability for companies to offer this insurance also needs innovation to reduce the cost of distribution, selling, managing and processing claims.

Typically, microinsurance makes use of tech and unconventional distribution channels. The claims processes are also managed via technology and through the design of the policy.

Some Examples of Microinsurance

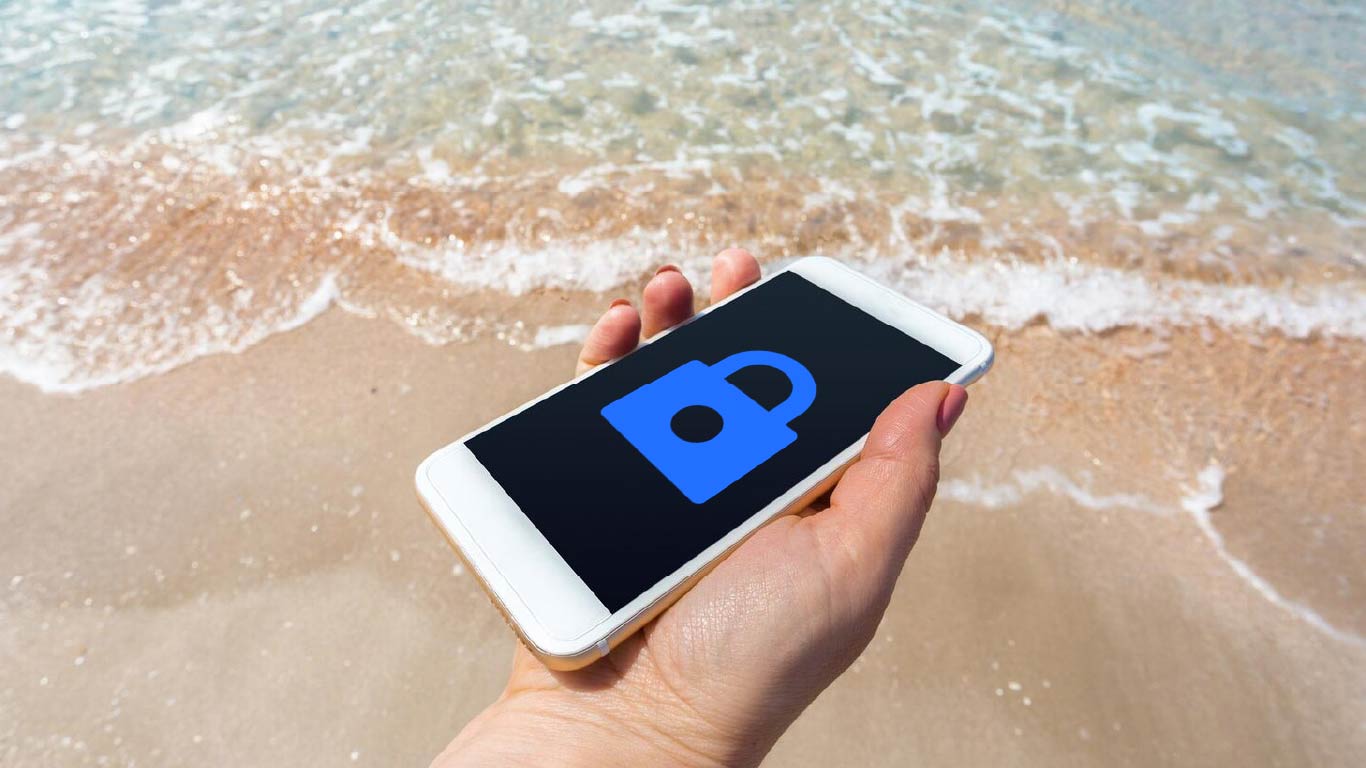

- Time-based constraints: Retail insurance products are time-based and not usage-based. A time-based insurance product assumes that a customer is exposed to an equal level of risk over the entire year. For example – car insurance, normal car insurance averages out the risks across many users. However, if a car stays in a garage for 170 days a year and then only does 3,000 miles , why should a customer buy insurance for the entire 365 days of the year? A microinsurance product that tracks the ‘usage’ of an asset will be much more interesting and useful to customers.

- Event-based coverage: Customers are more open to buying insurance before they engage in a specific event. For example, personal accident cover based on usage and shared risk, for example before a long weekend drive. Why buy annual cover when you only travel (or assume greater risks) occasionally. Once the event is completed, the perceived need goes away. Designing ‘micro insurance’ products that specifically cover an event risk reduces the price and increases acceptability among customers.

- Need-based coverage: Insuring your entire home might not make sense while insuring your new gadgets like computers, white goods and phones might.

- Buying a broad-based health insurance might not be valuable for youngsters but buying a broken-bones insurance might be. Identifying the specific need to the specific profile of customers reduces the cost of insurance.

The key focus here is to bring the benefits of insurance to more people by developing products and processes to make these benefits to customer’s problems who cannot normally buy high premium insurance.

Microinsurance is growing and the model could be the next thing in countries like India where insurers offer low priced products to increase the ‘culture’ of buying insurance among youngsters.

As they say, insurance is a product where everyone knows the price but only a few understand the value. This is because typically insurance is purchased because you MUST – such as car insurance or home insurance linked to loans. Where as most of the worlds’ assets and events are simply not covered and this brings much distress to people when the worst happens. Insurance is meant to help people in their time of need. Microinsurance, owing to its focus and use of technology, can enable this.

It is an innovation at product level which is steadily attaining the attention of customers. Microinsurance plans are based on extremely low premium rates. Because of its affordability and specificity, more people can get the advantages of insurance.

Microinsurance is not only going to benefit the low-income strata. Companies involved in offering micro plans can equally capitalise on the new business models such as the platform businesses. These businesses are well represented in the sharing and gig economy and they have a need for insurance that is based on micro insurance process. Policies by the hour or Km or event are being developed to fit around this market.

This directly points microinsurance sector towards its key profitability which is based upon ‘Low margin – High volume’ revenue model. Large volumes of micro-policies mean more business for the company. Selling larger volumes of microinsurance plans results in increased revenue and scalability.

The ability to gain profit will be the ability to process sales and claims very efficiently.