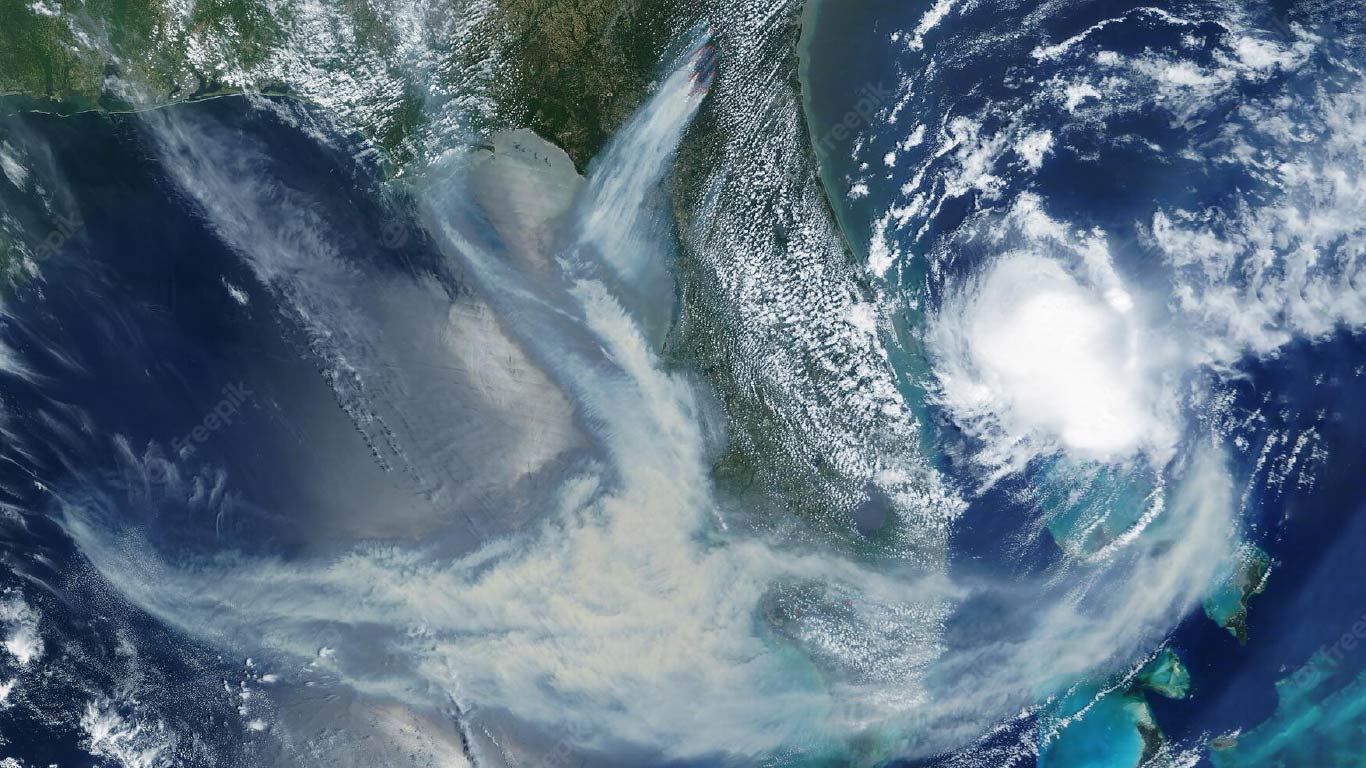

As MIC Global gears up to launch its first parametric insurance product in partnership with AXA and Brokerslink in Miami, Fl, we thought it a good time to open up a discussion on the subject. The product is Hurricane Insurance for Florida.

Parametric insurance or index insurance is growing in awareness across many industries and locations, however adoption of such insurance can be challenging for all concerned. However MIC Global makes it easy.

Insurance companies can be reluctant to offer index or parametric insurance owing to the perception it’s difficult to assess and overall, complicated to evaluate. Many insurers lack the needed knowledge and technical understanding to develop a sustainable and profitable parametric insurance solutions.

This is a pity since today many things can go wrong owing to population growth, urbanisation, climate change, technological growth and an overall growth in economic activity around the world. This environment should be ideal for insurance – the aim of insurance is to offer resilience to its customers in time of need, this is the fundamental thing insurance offers – a way of recovering when things go wrong. As the world grows more complex, insurance should grow in importance and prominence.

The way insurance responds is a challenge. Insurance gets a bad press owing to the policies being complex and when the time comes to make a claim its often hard and time consuming. Consumers and business owners can feel let down in their time of need by their insurer. Greater use of technology and awareness of the customer in insurance is causing changes however and parametric’s is just one example of this.

Parametric insurance is being talked about more and more across the global insurance and reinsurance industry and is often linked to the fact that of all the losses in the world many are not covered by insurance. In the developed world only 30% of losses are covered and in the developed world it is less then 10%. With weather related losses growing this situation is only going to get worse. Parametrics is a way to tackle this protection gap.

The case for parametric insurance is growing and it has several advantages over more established forms of insurance. Parametric insurance can be developed to cover specific needs and can offer very commercially viable forms of protection owing to the high use of tech such as Artificial Intelligence (AI) and Machine Learning to monitor and trigger the insurance payments. Data is the key and new data sets are being used together with technology such as Internet of Things (IoT) and other sensors and devices. Gaining a strong correlation between the insurable risk and the data is key.

Parametric solutions are suitable for many instances, building resilience into personnel lives and commercial businesses alike. Building a suit of products that can be deployed globally based on a set of technology and data points is possible. This is matched with the ability to monitor and manage the claims process with high levels of automation.

Clarity and communication is key to its success, ensuring that customer understand the product and can see and join in with the use of the product. Data analytics and visualisations aimed at the insured can be developed to aid the communication of the policies and these can be transparent to the user, showing in real time how the policy is performing against the event(s) under the policy.

Perhaps this will see customer satisfaction levels move off rock bottom!